Unlocking Financial Success with an Online Financial Adviser

/0 Comments/in News/by Rob LaurieSuccess with an Online Financial Adviser

In today’s fast-paced, digital-centric world, the quest for financial success is a shared aspiration. The financial landscape is complex, layered with opportunities, risks, and a constant flux of market trends. Navigating this dynamic terrain necessitates expertise, personalized strategies, and a visionary approach. This is where an online financial adviser steps in, bridging the gap between your financial goals and the means to achieve them.

1. Accessibility: Breaking Geographical Boundaries

One of the significant advantages of opting for an online financial adviser is unparalleled accessibility. Regardless of geographical location, clients can access top-notch financial advice, making this model particularly beneficial for individuals in remote or rural areas. The digital nature of these services means that international clients or those with non-traditional schedules can seek advice that suits their lifestyle, breaking down time-zone barriers.

2. Convenience: Tailored to Your Lifestyle

In an era where time is a precious commodity, the convenience offered by an online financial adviser is invaluable. Clients have the flexibility to schedule appointments outside traditional business hours, catering to diverse work routines and personal commitments. The immediacy of online services means that advice and automated services are often at your fingertips, providing support when you need it the most.

3. Cost-Effectiveness: Financial Advice for Every Budget

The shift to the digital realm often translates to competitive fees, with online financial advisers eliminating the overheads associated with a physical office. Transparent pricing models are a staple of online services, empowering clients with a clear understanding of costs upfront. Additionally, the availability of scalable services means clients have the flexibility to choose offerings that align with their needs and budget, democratizing access to financial expertise.

4. Technological Advancements: Embracing the Future of Finance

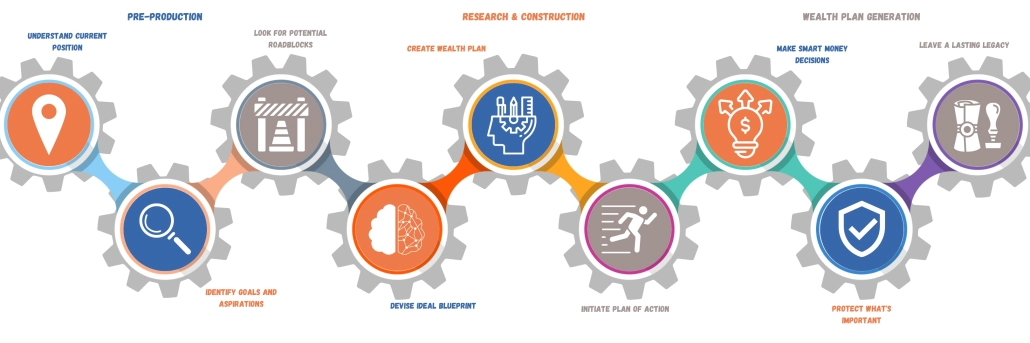

The financial industry is at the forefront of technological innovation, with online financial advisers leveraging cutting-edge tools to enhance their services. Robo-advisors, which employ sophisticated algorithms to provide tailored financial advice, are a testament to the fusion of finance and technology. Clients benefit from personalized insights, driven by data analytics, ensuring that advice aligns with individual financial goals and risk tolerance.

Moreover, online platforms feature financial tools and dashboards that allow clients to monitor their investments, track financial goals, and gain a comprehensive view of their financial health. These technological advancements are not just about convenience; they are about equipping individuals with the tools to make informed financial decisions and fostering a sense of financial empowerment.

5. Personalized Services: Crafting Your Financial Narrative

Personalization is at the heart of effective financial advice. Online financial advisers utilize advanced analytics to craft strategies that resonate with your financial narrative. The integration of various financial accounts provides a holistic view of your financial landscape, forming the foundation for customized advice. This approach is not about a one-size-fits-all solution; it’s about understanding the uniqueness of each client’s financial journey and tailoring advice accordingly.

6. Educational Resources: Elevating Financial Literacy

Education is a powerful tool in the quest for financial success. Online financial advisers often curate a wealth of educational content, including blogs, webinars, and resource materials. This informational treasure trove is designed to demystify financial concepts, provide market insights, and empower clients with the knowledge to make informed decisions. The emphasis on financial literacy is not just about immediate gains; it’s about fostering a long-term understanding of financial principles, laying the groundwork for sustained financial well-being.

7. Document Management: Streamlining Financial Transactions

In the digital age, document management is seamless. Online financial advisers facilitate electronic record-keeping, ensuring that financial documents are securely stored and easily accessible. The shift to paperless transactions is not only environmentally friendly but also eliminates the hassle associated with traditional paper documentation. This streamlined approach enhances the client experience, allowing individuals to focus on what truly matters – their financial goals.

8. Regular Updates and Alerts: Staying Informed in Real-Time

In the dynamic world of finance, staying informed is key. Online financial advisers provide real-time notifications, market insights, and financial news, keeping clients abreast of developments that could impact their financial landscape. These regular updates are not just about information; they are about providing clients with the insights needed to make timely, strategic financial decisions.

Conclusion: Charting the Path to Financial Success with an Online Financial Adviser

Navigating the financial terrain is a journey filled with opportunities, challenges, and pivotal decision-making moments. An online financial adviser is your compass, guiding you through the complexities, offering personalized advice, and empowering you with the knowledge and tools to achieve your financial aspirations. In embracing the digital revolution, we unlock the door to accessible, convenient, and innovative financial advice, charting the path to a future of financial success and well-being. The journey to financial prosperity is a click away – are you ready to take the first step?